- Home

- Sustainability Report

- Mitsubishi Materials Group's Initiatives on Material Issues

- Enhancement of engagement with stakeholders

Activation of Communication

Enhancement of Engagement with Stakeholders

- Interaction with Stakeholders

- Responding to the Expectations and Needs of Stakeholders

- Main External Evaluation for the Mitsubishi Materials Group’s Activities

- Distribution of Economic Value to Stakeholders

- Dialogue with Shareholders

- Dialogue with Investors

- Labor Union and Management Partnership

- Communication Measures

Interaction with Stakeholders

Basic Approach to Building Relationships with our Stakeholders and Key Means of Communication

In the interests of sustainable corporate management, we believe that communicating with our stakeholders is crucial if we are to incorporate their expectations and requirements into our business strategies and activities. While creating more opportunities for communication, our aim is to reflect stakeholders’ perspectives in our management practices to a greater extent than ever before.

Basic Approach to Building Relationships with Our Stakeholders and Key Means of Communication

Relationships between stakeholders and businesses

| Stakeholders | Relationship with businesses |

|---|---|

| Shareholders & Investors |

|

| Customers |

|

| Employees |

|

| Local Communities |

|

| Business Partners (Suppliers) |

|

| Industry/Economic Organizations |

|

| Non-profit Organizations (Educational/Research Institutions, NGOs & NPOs) |

|

| Government |

|

| Environment & Future Generations |

|

Responding to the Expectations and Needs of Stakeholders

We respond to issues highlighted and suggestions made by our stakeholders so that we can improve the standard of our sustainable management. We have launched a number of initiatives in response to key comments and requests, including the following. For information on methods of communication with stakeholders when ascertaining details, please see “Interaction with Stakeholders”.

| Key expectation and request | Group response |

|---|---|

| Continuing to expand and improve resource recycling measures |

|

| Responding to the risks and opportunities associated with climate change |

|

| Managing closed mines |

|

| Preserving biodiversity (company-owned forests, areas around mines) |

|

| Respecting human rights throughout the supply chain |

|

| Quality control |

|

| Creating safe, healthful working environments |

|

| Talent development |

|

| Promoting greater roles for diverse talents |

|

| Strengthening information security |

|

| The evolution of corporate governance |

|

Main External Evaluation for the Mitsubishi Materials Group’s Activities

Main Awards and Commendations from Outside Organizations (FYE March 2024)

| Recipient | Awarding body or organization |

Details | |

|---|---|---|---|

| Mitsubishi Materials Corporation Monozukuri and R&D Strategy Dept., Corporate Research & Development Strategy Dept. Innovation Center |

Japan Institute of Copper, Japan Copper and Brass Association | Japan Institute of Copper, Japan Copper and Brass Association 57th Annual Paper Award | Effects of Minute Amounts of Additives on the Properties of Oxygen-free Copper for High Current Applications |

| Mitsubishi Materials Corporation Innovation Center |

The Japan Institute of Electronics packaging | 32nd Microelectronics Symposium (MES2022) Best Paper Award | Self-alignable sintered bonding materials |

| 33rd Microelectronics Symposium (MES2023) Research Encouragement Award | Development of next-generation joining technology using nanoporous Cu | ||

| Japan Mining Industry Association | 74th Japan Mining Industry Association Award | Biosorption of gold by baker's yeast and development of new materials, Highly sensitive analysis of environmentally regulated elements by Hydra Mist/ICP optical emission spectrometry | |

| The Ceramic Society of Japan | 77th The Ceramic Society of Japan Technical Encouragement Award | Application of liquid-phase deposition technology to protective films and composite functionalization technology | |

| The Japan Society for Analytical Chemistry | The Japan Society for Analytical Chemistry merit award | Meritorious service through many years of analytical practice | |

| Japan Welding Society | Japan Welding Society "Interface Bonding Research Award" |

Development of core-shell structured powder with Sn on the surface of Cu particles | |

| Mitsubishi Materials Corporation Copper & Copper Alloy Business Div. Sales Unit. Rolled Product Sales Dept. |

FUJI ELECTRIC CO., LTD. Semiconductor Business Group | Certificate of commendation | Amid tight supply of copper materials, the company smoothly supplied copper materials for terminal cases, contributing to the company's stable supply. |

| Mitsubishi Materials Corporation Tsukuba Plant |

Japan Cutting & Wear-resistant Tool Association | Environmental Award | Those recognized as a business site that has achieved outstanding results in meeting the goals of the Voluntary Action Guidelines for the Environment and that serves as a model for other members. |

| Environmentally Harmonized Tools |

| ||

| The Nikkan Kogyo Shimbun, Ltd. | Super Monozukuri Parts Award | MC5100 Series of Inserts for Cast Iron Turning Recognized as Excellent Parts and Components that Contribute to the Competitiveness of Japanese Manufacturing and the Development of Industry and Society | |

| Japan Cutting & Wear-resistant Tool Association | Environmental Activity Award | Reduction of electricity and CO2 emissions for pressurized air facilities through "compressed air supply optimization" initiatives | |

| Luvata Superconductors (Zhongshan) Limited. | Huangpu Town | Outstanding economic contribution award for 2023 | Huangpu Town Outstanding economic contribution award for 2023 |

| 2024 "Star Plan" Key Enterprise for 2024 | Huangpu Town 2024 "Star Plan" Key Enterprise for 2024 | ||

| Zhongshan City | Manufacturing Enterprise Digital and Intelligent Demonstration Workshop for 2022 | Zhongshan City Manufacturing Enterprise Digital and Intelligent Demonstration Workshop for 2022 | |

| A-level taxpayer of tax credit for the year 2023 | A-level taxpayer of tax credit for the year 2023 | ||

| MOLDINO Tool Engineering, Ltd. Narita Plant | Chiba Prefecture Federation of Labor Standards Associations | Award for good safety management | Narita Plant's establishment of a safety management system recognized |

| Hachimantai Green Energy Co. Ltd. | Kazuno Area Business Owners' Association for the Promotion of Traffic Safety, Kazuno Area Safe Transportation Managers' Association | Outstanding performance in the accident-free and violation-free contest in the fiscal year ended March 2024 | Recipients recognized for outstanding performance in the fiscal year ended March 2024 No Accidents and No Violations Contest |

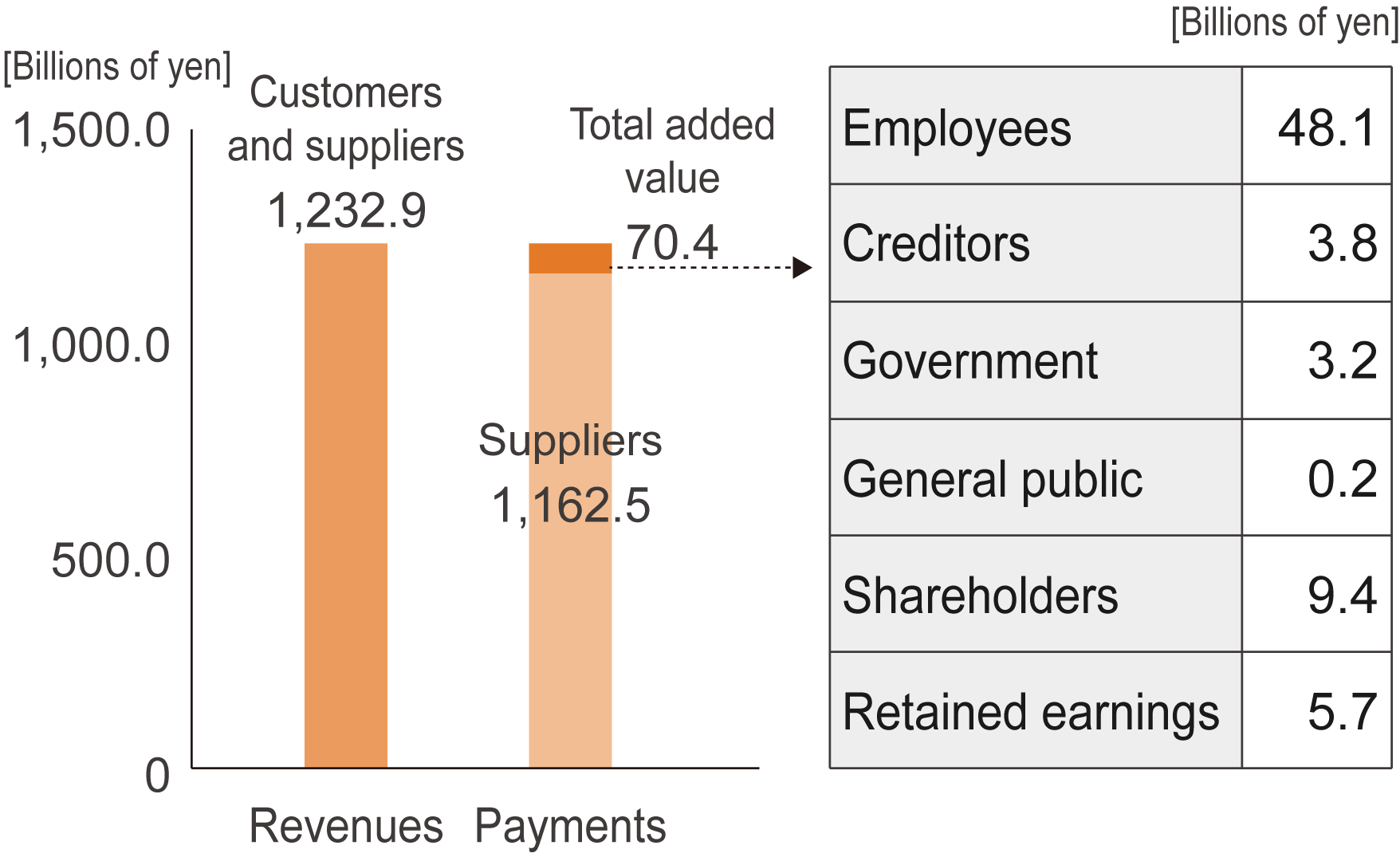

Distribution of Economic Value to Stakeholders

Striving to Adequately Distribute Economic Value

As we continue to earn operating revenue and generate economic value added thanks to the involvement of our diverse range of stakeholders, we believe that it is important to fulfill our social responsibilities and adequately distribute that added value among our stakeholders.

Economic Value Added in FYE March 2024

Revenue for Mitsubishi Materials in the fiscal year ended 2024 came to \1,232.9 billion. That included proceeds from the sale of products and services, dividends and other forms of non-operating income, and extraordinary income. Operating costs, which consist primarily of payments to suppliers, totaled \1,162.5 billion.

After subtracting operating costs from our total revenue, the amount of added value generated through our business activities came to \70.4 billion.

Distribution of Added Value

Personnel costs, which include statutory welfare expenses and retirement benefit costs contributions and represent the portion of revenue distributed to our employees, came to \48.1 billion.

In the meantime, we distributed a total of \3.8 billion to financial institutions and other creditors, in the form of interest on borrowings. We distribute value to society and local communities through the government and through our own social contribution activities. We paid \3.2 billion to the government this year, as the combined total of corporate income tax plus other taxes and public charges liable as expenses. We also gave \0.2 billion back to the community in the form of social contribution activities, including donations, lending our facilities to the public and providing employees’ services.

Cash dividends, which represent the value that we distribute to our shareholders (companies and individuals, in Japan and overseas), came to a total of \9.4 billion.

Retained earnings to cover investment and contingencies for the future meanwhile totaled \5.7 billion.

Economic Added Value

| Category | Stakeholder | Amount (millions of yen) | Details/method of calculation |

|---|---|---|---|

| Revenues | Customers and suppliers | 1,232,905 | Net sales, non-operating income, extraordinary income |

| Payments | Suppliers | 1,162,460 | Operating costs (cost of sales and selling, general and administrative costs, minus deductions for personnel costs, tax and public charges, and donations) |

| Employees | 48,112 | Personnel costs (including statutory welfare expenses and retirement benefit expenses) | |

| Creditors | 3,769 | Interest expense | |

| Government | 3,181 | Taxes (corporate income tax, and other taxes and public charges liable as expenses) | |

| General public | 221 | Donations, etc.* | |

| Shareholders | 9,422 | Cash dividends paid | |

| Retained earnings | 5,741 | Net income minus cash dividends paid |

- * Calculated based on the value of items such as donated goods, public lending of our facilities and the provision of employees’ services as well as cash donations, as specified by Nippon Keidanren.

Contributing to Local Communities as part of our Overseas Operations

Whenever we engage in business activities overseas, we make every effort to understand conditions in each country and the national identity of its people, placing an emphasis on engaging in activities as a member of the local community. In addition, we re-invest revenue earned from our overseas operations back into the local community wherever possible, in order to continue growing our business and contribute to the sustainable development of the local area.

Pension Contributions

Obligations relating to unfunded lump-sum severance payment plans and funded defined benefit pension plans totaled \32.0 billion and \39.3 billion respectively. \75.6 billion of this total was paid out in the form of pension assets to outside funds (coverage: 105.9%). In addition, \2.4 billion was registered as expenses in the form of accrued retirement benefits, with the remaining amount of \-6.7 billion classed as unrecognized benefit obligations. We plan to amortize all unrecognized benefit obligations over the next ten years. Unrecognized retirement benefit liabilities are mainly posted as expenses based on the straight-line method for a 10-year period.

Financial Assistance from the Government

We received the amount of \0.7 billion in grants, subsidies and other financial assistance from the government. The government does not hold shares in Mitsubishi Materials or any of our Group companies.

Dialogue with Shareholders

Our Ordinary General Meeting of Shareholders offers an invaluable opportunity for direct communication between our management members and shareholders. We therefore strive to send out materials relevant to the meeting at the earliest possible date, while also providing the materials on our website well in advance of statutory deadlines, to give shareholders sufficient time to consider the matters to be presented and resolved at the meeting. In addition, we are striving to enhance the disclosure of information in materials for the General Meeting of Shareholders.

Besides permitting shareholders to exercise their voting rights in writing or online, we have introduced an electronic voting platform to facilitate voting by both domestic and international institutional investors. We use slides with accompanying narrations at the General Meeting of Shareholders to help ensure participants’ clear comprehension of the presented contents. We also publish shareholders’ voting results for every resolution on the Website, after the meeting. Further, to improve convenience for shareholders, a hybrid participation-type General Meeting of Shareholders (live streaming) has been conducted from the 96th Ordinary General Meeting of Shareholders held on June 24, 2021. The streamed video of the General Meeting of Shareholders is also posted on the Company’s website for a certain period of time.

Distribution of Shareholders

Dialogue with Investors

In the fiscal year ended March 2024, financial results briefings (quarterly), Management Briefing, Business Strategy IR Meeting, Sustainability IR meeting, and Manufacturing Excellence & DX Briefing were held for stakeholders. At each meeting, after explaining the contents of our financial results, management strategy and sustainability initiatives, R&D etc., we set aside time for questions and answers in an effort to strengthen communication with participants. We communicated the feedback received from participants in a timely fashion through the IR reports published for senior management each month, and posted records including the details of the briefings and Q&A sessions to our website for viewing by individual investors.

We also actively exchanged opinions and communicated with institutional investors and securities analysts through individual meetings with institutional investors and securities analysts, small meetings with the CEO, CFO and Outside Directors, and participation in conferences hosted by securities companies. We also endeavored to communicate with individual investors by taking part in briefings for individual investors, and by posting our Material News shareholder newsletters on our website.

Going forward we will continue to engage in proactive IR and SR activities by deepening dialogue with stakeholders and maintaining and improving information disclosure.

IR and SR Activities in FYE March 2024

| Item | Number of times held during FYE March 2024 |

|---|---|

| Financial Results Briefing (quarterly) | 4 |

| Management Briefing | 1 |

| Business Strategy IR Meeting | 1 |

| Sustainability IR Meeting | 1 |

| Manufacturing Excellence & DX meeting | 1 |

| Individual IR/SR meeting | 164 |

| Overseas IR | 13 |

| Briefing for individual investors hosted by a securities company | 2 |

Labor Union and Management Partnership

Under our union shop scheme, we respect collective bargaining rights and freedom of association as the basic rights of workers, thereby striving to maintain a good labor-management relationship. The scheme also enables us to share information and exchange opinions between labor union and management on a regular basis. In particular, our biannual Labor-Management Conference, which is held within a year with the Mitsubishi Materials Federation of Labor Unions, is aimed at strengthening solidarity through active discussion, covering subjects such as recent issues, strategies and policies in each sector, and establishing a shared direction in the interests of the Company’s sustainable growth for the future.

Also, management spends substantial time on careful explanation and consultation with labor upon facing such events as proposal of measures. The Current number of union members amongst those directly employed by Mitsubishi Materials (including employees on assignment) stood at 4,064. Including labor unions of Group companies that belong to Mitsubishi Materials Federation of Labor Unions, the total number of members was 6,328 (as of April 2024).

Number of Union Members (full-time equivalent)

| Item | Number of employees |

|---|---|

| Non-consolidated | 4,064 |

| Consolidated | 6,328 |

Communication Measures

The Group implements various communication measures with the aim of becoming an organization with good and healthy communication where employees have unrestricted communication. The Group began its inner branding activities in the fiscal year ended March 2022 with the aim of ensuring that each individual employee feels a sense of ownership in "Our Commitment." We are implementing numerous initiatives based on the three directions of "1. Communication with management," "2. Connect every single employee and the entire Group horizontally" and "3. Support each challenge."

Mitsubishi Materials Corporation started distributing smartphones to all employees in the fiscal year ended March 2023. This is intended to activate internal communication through means such as delivering information to employees in a timely manner and enabling employees to communicate with each other using chat functions while also promoting DX and improving operational efficiency.

Activities to raise awareness of Our Commitment were a key focus in the fiscal year ended March 2024, and we utilized our framework of existing measures as we made progress in this area.

List of Measures

| Measure | Content |

|---|---|

| Ambassador activities | Ambassadors are appointed from throughout the Group through an open application process. They promote inner branding, and have been actively fulfilling this role since the fiscal year ended March 2022. |

| Internal radio-style broadcasts | Created to promote communication with managers and employees, regular radio-style broadcasts where the CEO personally acts as an entertainment personality, answering a range of questions from Group employees, have been delivered since the fiscal year ended March 2022. |

| Half-day workplace experiences | Half-day workplace experiences are being carried out as an opportunity for employees to experience jobs at other workplaces. This started in the fiscal year ended March 2022, with about 70 people taking part. |

| Reverse mentoring | Reverse mentoring is a program in which young employees become the mentors and give mentoring to management. Discussing various themes from a standpoint different from that of work provides opportunities to gain mutual awareness. |

| Town Hall Meetings | In connection with internal branding activities, we hold Town Hall Meetings as a way to enhance communication of management information and promote two-way dialogue. We held 42 meetings covering 6 themes in the fiscal year ended March 2024. |

Key Visual Development

We have created a key visual with the aim of fostering recognition and understanding of Our Commitment by representing it in a visual form. The circular design represents the uninterrupted and powerful circulation of metal resources and their growth while adding further value. The texture evokes metal, expressing Mitsubishi Materials’ unique approach to resource circulation. This key visual is widely used in documents such as internal posters and templates.

Circulation Map

We have developed a Circulation Map as a communication tool to help each individual employee to see the role they play in realizing Our Commitment. This map is used in various settings, from Officer messages at the start of each fiscal year to internal events, and is helping to foster ownership of Our Commitment.

Upper Management Communication Work

Aiming to close the gap between upper management and employees and foster an organization with good and healthy communication where employees have unrestricted

communication, members of management have been visiting Group locations to create opportunities for dialogue with employees.

In the fiscal year ended March 2024, a total of 77 meetings were held at 51 sites, with opinions on the FY2031 Strategy being exchanged.

Employees’ questions covered wide-ranging topics, including the business strategies aiming to realize Our Commitment and everyday issues, and a lively exchange of opinions took place.

In the fiscal year ended March 2024, in addition to carrying on existing measures, we deepened our activities through a strategic, multifaceted approach covering both the revitalization of our organizational culture and awareness of Our Commitment while leveraging our framework of measures, including incorporating some discussions on Our Commitment.